The rial (ISO 4217 code IRR) is the currency of Iran. It is subdivided into 100 dinar but, because of the very low current value of the rial, no fraction of the rial is used in accounting.

Although the "toman" is no longer an official unit of Iranian currency, Iranians commonly express amounts of money and prices of goods in "tomans." For this purpose, one "toman" equals 10 rials. Despite this usage, amounts of money and prices of goods are virtually always written in rials. For example, the sign next to a loaf of bread in a store would state the price in rials, e.g., "200 Rials," even though the clerk, if asked, would say that the bread costs "20 tomans."

There is no official symbol for the currency but the Iranian standard ISIRI 820 defined a symbol for use on typewriters (mentioning that it is an invention of the standards committee itself) and the two Iranian standards ISIRI 2900 and ISIRI 3342 define a character code to be used for it. The Unicode Standard has a compatibility character defined for "RIAL SIGN" at the position U+FDFC.

History

The rial was first introduced in 1798 as a coin worth 1250 dinar or one eighth of a toman. In 1825, the rial ceased to be issued, with the qiran of 1000 dinars (one tenth of a toman) being issued as part of a decimal system. The rial replaced the qiran at par in 1932, although it was divided into one hundred (new) dinars.

Prior to decimalisation in 1932, these coins and currencies were used, and some of these terms still have wide usage in Iranian languages and proverbs:

| Old currency | In dinar | First issue |

|---|---|---|

| shahi | 50 dinar | Samanid dynasty |

| mahmoudi (sannar) | 100 dinar | Sultan Mahmoud |

| abbasi | 200 dinar | Shah Abbas |

| naderi (da-shahi) | 500 dinar | Nader Shah |

| qiran | 1000 dinar | Fath Ali Shah(1825) |

| rial | 1250 dinar | Fath Ali Shah (1798) |

| dozari | 2000 dinar | Qajar dynasty |

| panjzari | 5000 dinar | Qajar dynasty |

| toman | 10000 dinar | Ilkhanate |

Value

In 1932, the exchange rate with the British pound was 1 pound = 59.75 rial. This changed to 80.25 in 1936, 64.350 in 1939, 68.8 in 1940, 141 in 1941 and 129 in 1942. In 1945, Iran switched to the U.S. dollar as the peg for its currency, with 1 dollar = 32.25 rial. The rate was changed to 1 dollar = 75.75 rial in 1957. Iran did not follow the dollar's devaluation in 1973, leading to a new peg of 1 dollar = 68.725 rial. The peg to the U.S. dollar was dropped in 1975.

In 1979, 1 rial equaled $0.0141. The value of Iran's currency declined precipitously after the Islamic revolution because of capital flight from the country.Studies estimate that the flight of capital from Iran shortly before and after the revolution is in the range of $30 to $40 billion.Whereas on 15 March 1978, 71.46 rials equaled one U.S. dollar, in July 1999, 9430 rials amounted to one dollar. However, the value of the rial has become more stable since 1999, as the economy of Iran has been growing rapidly and away from the dollar zone.

Injecting sudden foreign exchange revenues in the economic system forms the phenomenon of "Dutch disease" in a country. There are two main consequences for a country with Dutch disease: loss of price competitiveness in its production goods, and hence the exports of those goods; and an increase in imports. Both cases are clearly visible in Iran.

Although described as an (interbank) "market rate", the value of the Iranian rial is tightly controlled by the central bank. The state ownership of oil export earnings and its large reserves, supervision of letters of credit, together with current - and capital outflow account - outflows allows management of demand. The central bank has allowed the rial to weaken in nominal terms (4.6% on average in 2009) in order to support the competitiveness of non-oil exports.

There is an active black market in foreign exchange, but the development of the TSE rate and the ready availability of foreign exchange over 2000 narrowed the differential to as little as IR100 in mid-2000.

Monetary policy is facilitated by a network of 50 Iranian-run forex dealers in Iran, the Middle-East and Europe. According to the WSJ and dealers, the Iranian government is selling $250 million daily to keep the Iranian rial exchange rate against the US dollar between 9,700 and 9,900 (2009).

Exchange rates: Rials per US dollar - 9,900 (2009), 9,143 (2008), 9,326 (2007), 9,246 (2006); 8,964 (2005); 8,885 (2004); 8,193 (2003)

Pre-unification, Rials per US dollar: Market: 8,200 (2002); 8,050 (2001); 8,350 (2000) Preferred: 6,906 (2002); 1,753 (2001); 1,764 (2000)

Exchange rate system

Until 2002, Iran's exchange rate system was based on a multi-layered system, where state and para-state enterprises benefited from the "preferred or official rate" (1750 rial for $1) while the private sector had to pay the "market rate" (8000 rial for $1), hence creating an unequal competition environment. The "official rate" of the Iranian rial-1,750 per U.S. dollar-applied to oil and gas export receipts, imports of essential goods and services, and repayment of external debt. The "export rate", fixed at 3,000 rials per dollar since May 1995, applied to all other trade transactions, but mainly to capital goods imports of public enterprises.

In 1998, in order to ease pressure on exporters, the central bank introduced a currency certificate system allowing exporters to trade certificates for hard currency on the Tehran Stock Exchange, thus creating a floating value for the rial known as the "TSE rate" or "market rate". This method finally replaced the fixed export rate in March 2000, and has since held steady at some IR8,500:US$1. In March 2000, the TSE rate officially replaced the (IR3,000:US$1) "export rate".

In March 2002, the multi-tiered system was replaced by a unified, market-driven exchange rate. In 2002 the "official rate" a/k/a as the "prefered rate" (IR1,752:US$1) was abolished, and the TSE rate became the basis for the new unified foreign-exchange regime.

Redenomination

Because of the current low value of rial, and that people rarely use the term, redenomination or change of currency was first proposed in the late 1980s. The issue has re-emerged and been under discussion, as a result of issuance of larger banknotes in 2003. Opponents of redenomination are wary of more inflation resulting from psychological effects, and increase in velocity of money leading to more instabilities in the economy of Iran.

On 12 April 2007, the Economics Commission of the Parliament announced initiation of a statute in draft to change the currency, claiming redenominations has helped reduce inflation elsewhere, such as in Turkey.In 2008, an official at the Central Bank of Iran said the bank plans to slash four zeros off the rial and rename it the toman.The bank printed two new travelers cheques, which function quite similar to a banknote, with values of 500,000 and 1,000,000 rials. However, they have the figures "50" and "100" written on their top right hand corners, respectively, which is seen as the first step toward a new currency.

In 2010, President Ahmadinejad announced that Iran will finally remove three zeros (from four originally proposed) from its national currency as part of the economic reform plan.

Coins

First rial

Silver coins were issued in denominations of ?, ¼, ½ and 1 rial.

Second rial

The first coins of the second rial currency were in denominations of 1, 2, 5, 10 and 25 dinar, ½, 1, 2 and 5 rial, with the ½ to 5 rial coins minted in silver. Gold coins denominated in pahlavi were also issued, initially valued at 100 rial. In 1944, the silver coinage was reduced in size, with the smallest silver coins being 1 rial pieces. This year also saw the cessation of minting of all denominations below 25 dinar. In 1945, silver 10 rial coins were introduced. In 1953, silver coins ceased to be minted, with the smallest denomination now 50 dinar. 20 rial coins were introduced in 1972.

After the Islamic Revolution, the coinage designs were changed to remove the Shah's effigy but the sizes and compositions were not immediately changed. 50 dinar coins were only minted in 1980 and 50 rial coins were introduced in 1981. In 1993, a new coinage was introduced with smaller 1, 5, 10 and 50 rial coins and new 100 rial pieces. 250 rial coins were introduced the following year. In 2004, the sizes of the 50, 100 and 250 rial coins were reduced and 500 rial coins were introduced. New, smaller types of 250 and 500 rials were introduced in 2009, along with the new denomination of 1000 rials.

Banknotes

In 1932, notes were issued by the "Bank Melli Iran" in denominations of 5, 10, 20, 50, 100 and 500 rial. 1000 rial notes were introduced in 1935, followed by 200 rial notes in 1951 and 5000 and 10,000 rial in 1952. 5 rial notes were last issued in the 1940s, with 10 rial notes disappearing in the 1960s. In 1961, the Central Bank of Iran took over the issuance of paper money.

In 1979, after the Islamic revolution, Iranian banknotes featuring the Shah's face were counter-stamped with intricate designs to cover the Shah's face. The first regular issues of the Islamic Republic were in denominations of 100, 200, 500, 1000, 5000 and 10,000 rial. 2000 rial notes were introduced in 1986.

Issuance of larger notes

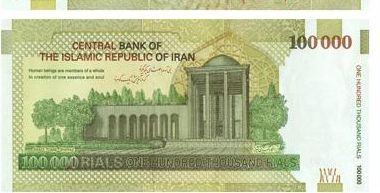

Printing banknotes larger than 10,000 rials was first proposed in 1989, and in 1992 the central bank asked for government permission to print 20,000, 50,000 and 100,000 rial notes. This was not realized at that time, due to fears of inflation and counterfeiting.10,000 rial note remained the highest valued note for more than 50 years, until 2010 when 100,000 rial notes were added.

On 4 March 2007, it was announced that Iran would issue a 50,000 rial banknote with the subject being the Iranian nuclear energy program. The note was issued on 12 March.The note features a quote by the prophet Mohammed, translated as: "Even if science is at the Pleiades, some people from the land of Persia would attain it".Banknotes currently in circulation are 100, 200, 500, 1000, 2000, 5000, 10,000, 20,000, 50,000 and 100,000 rials. After the death of Ruhollah Khomeini, his portraits were used on the obverse of 1000 rial banknote and greater.

Cash cheques

Currently the highest valued legal tender banknote issued by the central bank is 100,000 rials (about U.S. $10 in 2010).However 500,000 rial, 1,000,000 rial and 2,000,000 Iran Cheques circulate freely and are treated as cash.

The central bank used to allow major state banks to print their own banknotes known as "cash cheques". They were a form of bearer teller's-cheque with fixed amounts, printed in the form of official banknotes. Once they were acquired from banks, they could function like cash for a year. Two forms of these banknotes were available. One known as "Iran cheque" could be cashed in any financial institution, while the other could be cashed at the issuing bank. They were printed in 200,000, 500,000, 1,000,000, 2,000,000 and 5,000,000 rial values.

In 2008, CBI revoked this privilege from banks, and currently issues its own Iran Cheque in 500,000 and 1,000,000 and 2,000,000 denominations.

The text on this page has been made available under the Creative Commons Attribution-ShareAlike License and Creative Commons Licenses